Fortunately all the user FICO and you may VantageScore fico scores rely on a similar underlying suggestions-analysis from 1 of credit history-to determine their fico scores

Loan providers can decide and therefore model they wish to have fun with. In reality, some loan providers you’ll want to stick to old items due to the latest financing that could be involved in changing. And some mortgage lenders use elderly models of your own foot FICO Score to help you comply with recommendations out of bodies-supported home loan companies Fannie mae and you will Freddie Mac.

You also tend to wouldn’t see and this credit report and get good bank uses one which just fill out an application. They also every aim to make exact same forecast-the right that a person will end up 3 months delinquent into the an expenses (either in general or a particular kind of) within the next 24 months.

Because of this, the same activities make a difference to your entire credit ratings. For individuals who screen numerous credit scores, you might find that ratings vary depending on the rating design and which of your credit history they assesses. But, over time, you may find each of them have a tendency to increase and you can slide with her.

Overall, which have good credit helps make achieving your financial and personal specifications much easier. It can be the difference between qualifying or becoming declined having an important loan, for example a mortgage otherwise auto loan. And you will, it will yourself feeling how much you’re going to have to spend during the focus or charge when you’re acknowledged.

Such as for instance, the difference between taking out fully a thirty-season, fixed-price $250,one hundred thousand mortgage with an effective 670 FICO Score and you will a beneficial 720 FICO Get was $72 thirty day period. That is more cash you could be placing on the coupons or other financial desires. Along the life of the loan, that have an excellent get can save you $twenty six,071 inside focus money.

The credit file (yet not consumer credit ratings) may impact your in other ways. Some businesses can get review your credit file before making a hiring or strategy decision. And you may, for the majority says, insurance vendors may use credit-created insurance policies scores to greatly help dictate your premium getting vehicles, household and life insurance.

How to Alter your Fico scores

To change the credit scores, focus on the underlying factors that affect your ratings. Within a high rate, the fundamental measures just take are very simple:

- Create at least the minimal payment and make every loans costs punctually. Even just one late commission can also be damage the credit ratings and you may it will probably remain on your credit history for up to eight decades. If you believe it’s also possible to skip a repayment, reach out to creditors as soon as possible observe if they aid you otherwise give adversity options.

- Maintain your credit card balances low. The borrowing use rates is a vital scoring component that compares the present day harmony and you will borrowing limit out-of rotating account such as for example handmade cards. That have a decreased borrowing from the bank usage price can help your credit ratings. Those with excellent credit ratings generally have an overall total utilization speed on single digits.

- Open profile that is claimed to your credit reporting agencies. For those who have couple credit accounts, ensure that men and women you will do discover would-be put in their credit history. These may be installment levels, including student, vehicles, family otherwise signature loans, otherwise revolving levels, instance playing cards and credit lines.

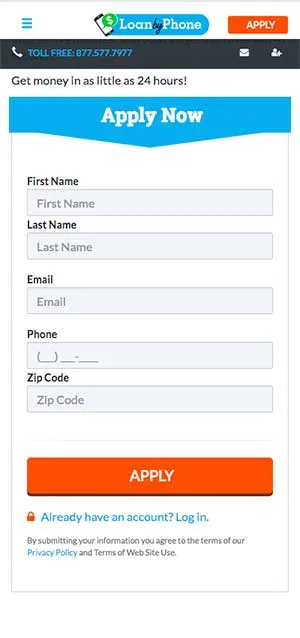

- Merely sign up for borrowing as it’s needed. Making an application for an alternative account can result in an arduous inquiry, which may damage the credit ratings a tiny. The latest impact can often be restricted, but obtaining many different types of finance or credit cards during a brief period can lead to a larger rating shed.